NAIROBI, Kenya – It’s been a long time coming—13 years, to be exact.

This marks a major turnaround for the cement giant, which posted a net profit of Sh1 billion for the year ending June 2024.

Breaking the 13-Year Dividend Drought

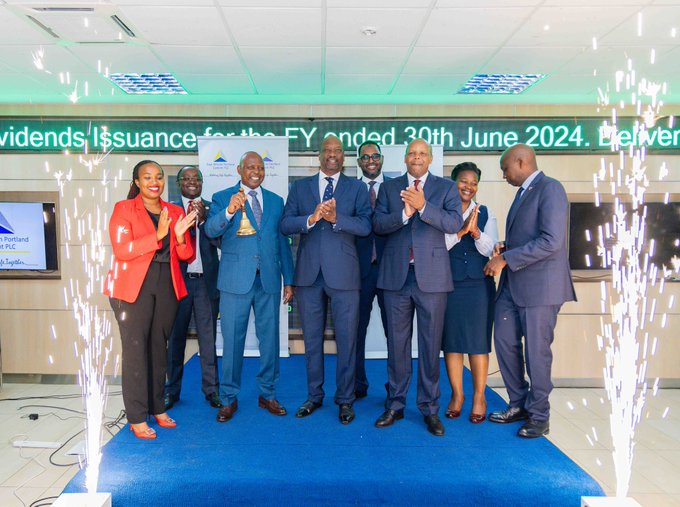

EAPC, a key player in Kenya’s cement industry, presented a Sh24 million dummy cheque to the National Social Security Fund (NSSF) and a Sh23 million cheque to the National Treasury at a ceremony held at the Nairobi Securities Exchange (NSE) trading floor.

The move underscores a significant financial rebound, considering the firm had not issued dividends since 2011.

“We are pleased to issue dividends to our shareholders. Their involvement with EAPC reflects continued trust and investment in the company’s success,” said EAPC Board Chairman Brigadier (Rtd) Richard Mbithi.

He emphasized that the milestone reinforces the company’s commitment to sustainable growth, financial resilience, and long-term shareholder value.

So, what’s fueling this comeback? A mix of strategic vision, operational efficiency, and a keen focus on market demand.

EAPC is doubling down on production capacity, diversifying its product portfolio, and positioning itself to tap into emerging markets across the region.

With Sub-Saharan Africa’s cement demand expected to grow by 77% by 2030—thanks to rapid urbanization and infrastructure expansion—EAPC is gearing up to meet the challenge.

The company’s strategy includes enhancing operational efficiencies and staying ahead of market trends to solidify its leadership in the sector.

This morning, the @NSE_PLC together with other capital markets stakeholders hosted the leadership and staff of East African Portland Cement as they celebrated a remarkable milestone-the handover of the first dividend cheques in over 10 years to shareholders.Today’s event

Sustainability at the Core

EAPC isn’t just about profits; it’s also pushing for cleaner energy solutions and community-driven initiatives that align with global Environmental, Social, and Governance (ESG) standards.

By balancing profitability with sustainability, the company is strengthening its reputation as a responsible industry leader.

The cement maker’s approach reflects a broader trend among African manufacturers embracing greener solutions while maintaining competitiveness.

With momentum on its side, EAPC is set to continue its growth trajectory, focusing on maximizing shareholder returns, driving innovation, and reinforcing its foothold in the industry.

Investors and stakeholders can expect a more resilient, forward-looking company poised to capitalize on Africa’s infrastructure boom.