NAIROBI, Kenya – The Kenya Revenue Authority (KRA) has published a list of countries that will automatically share financial information with Kenya under global tax transparency rules, in a move aimed at strengthening tax compliance and curbing offshore tax evasion.

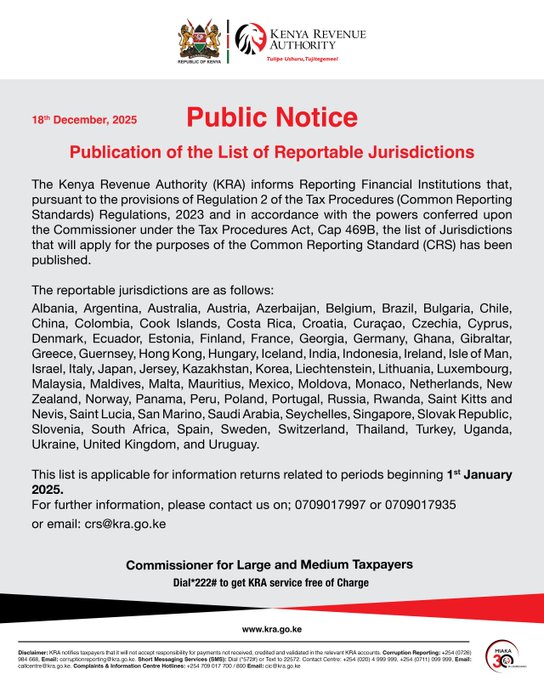

In a public notice dated December 18, 2025, KRA said the information exchange will be conducted under the Common Reporting Standard (CRS), in line with the Tax Procedures (Common Reporting Standards) Regulations, 2023.

Under the arrangement, financial institutions in more than 70 jurisdictions — including the United Kingdom, Germany, Uganda, South Africa, the United States’ close partners in Europe, and several Asian and Middle Eastern countries — will share details of financial accounts held by Kenyan tax residents with the KRA.

Other participating jurisdictions include France, China, Japan, Switzerland, Saudi Arabia, Singapore, the United Arab Emirates’ neighbours, Canada-linked territories, and regional hubs such as Mauritius, Seychelles, Rwanda and Ghana.

Kenya Revenue Authority has published a list of reportable jurisdictions.Key things to note:· This list of reportable jurisdictions is applicable for information starting Jan 1st, 2025· This is a build-up to the introduction of Common Reporting Standards in 2021 (see

The information exchange will apply to financial account data relating to periods beginning January 1, 2025.

KRA said the move is intended to enhance transparency in cross-border financial transactions and help the tax authority detect undeclared offshore income and assets held by Kenyan individuals and entities.

The CRS framework requires banks and other reporting financial institutions to collect and report information such as account balances, interest, dividends and proceeds from the sale of financial assets to their local tax authorities, which then share the data with partner jurisdictions.

KRA urged reporting financial institutions in Kenya to familiarise themselves with the published list of reportable jurisdictions and comply fully with their reporting obligations.

The authority said taxpayers seeking clarification on the new reporting requirements can contact KRA through its dedicated CRS support channels.