NAIROBI, Kenya — Kiharu Member of Parliament Ndindi Nyoro has raised fresh concerns over the proposed sale of the Government of Kenya’s 15 per cent stake in Safaricom PLC, warning that the transaction risks undervaluing one of the country’s most strategic assets.

In a memorandum addressed to Parliament and relevant government agencies, Nyoro questioned the valuation basis, negotiation process and transparency surrounding the planned divestment, arguing that the deal should be subjected to wider public participation and competitive bidding.

The MP said the proposed sale would be the largest asset disposal undertaken by the Kenyan government since independence and should therefore be handled with the discipline and mindset of a seller seeking maximum value.

“The National Treasury and the entire government must get as many views from Kenyans as possible and adopt them instead of justifying an inferior transaction,” Nyoro noted.

Concerns Over Valuation

Nyoro faulted the reliance on Safaricom’s current stock market price as the main benchmark for valuation, saying market prices do not necessarily reflect the company’s true worth, especially during prolonged bearish conditions at the Nairobi Securities Exchange (NSE).

He pointed out that Safaricom shares traded at about Sh 45 in 2021, translating to a valuation of over Sh 1.8 trillion, even before the company’s Ethiopia investment neared operational break-even.

According to Nyoro, profitability is expected to improve significantly once the Ethiopia unit stops posting losses, a factor he says should be factored into valuation discussions.

Our Memorandum as presented today before the joint Committee of Finance & National Planning and Public Debt & Privatisation on the Proposed sale of GoK’s 15% stake in Safaricom, Nairobi, Kenya.1. Kenya must open up the transaction to international bidders.2. The valuation is

Market Prices ‘Not a True Measure’

The MP argued that many NSE-listed companies are currently undervalued, citing examples across the energy, insurance and banking sectors to demonstrate what he described as erratic and unreliable market pricing.

He noted that Kenya Power, KenGen and Kenya Re all trade at valuations far below the value of their assets and earnings, while most local banks are trading below book value despite strong fundamentals.

“Based on these examples, it would be incompetent for Kenya to enter into negotiations with market price as the basis,” he said.

Process and Competition Questions

Nyoro also questioned how the current buyer was identified, asking whether the government had effectively closed the process to other potential bidders.

“For the right price to be achieved, you cannot close the process to other bidders,” he said, arguing that competitive bidding would unlock significantly more value for taxpayers.

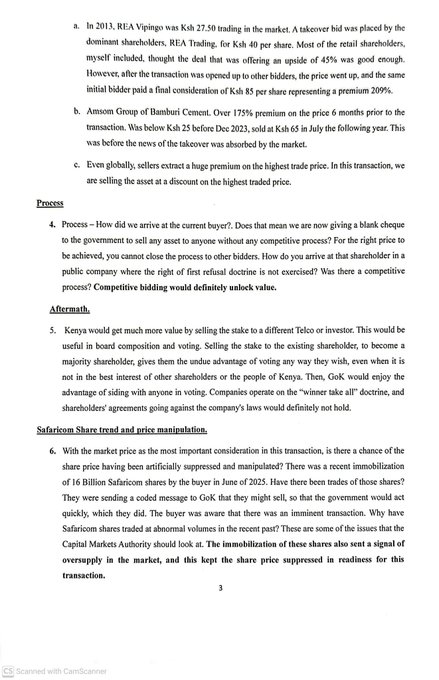

He cited past takeover transactions — including REA Vipingo and Bamburi Cement — where open bidding resulted in massive premiums above initial offers.

Share Price Manipulation Fears

In the memorandum, Nyoro further raised concerns about possible share price suppression, pointing to the immobilisation of about 16 billion Safaricom shares in June 2025 by the buyer.

He suggested that the immobilisation may have sent a signal of oversupply in the market, contributing to downward pressure on the share price ahead of the transaction.

“These are issues the Capital Markets Authority should interrogate,” he said.

Call for Oversight

Nyoro concluded by warning that selling the stake to an existing shareholder could tilt voting power and board influence, potentially disadvantaging minority shareholders and the public interest.

He called for greater scrutiny by Parliament and regulators to ensure the transaction delivers maximum value and protects Kenyans’ long-term interests.