NAIROBI, Kenya – If you’re planning to send money at 1 a.m. Monday night, you might want to hit that Send button a little earlier.

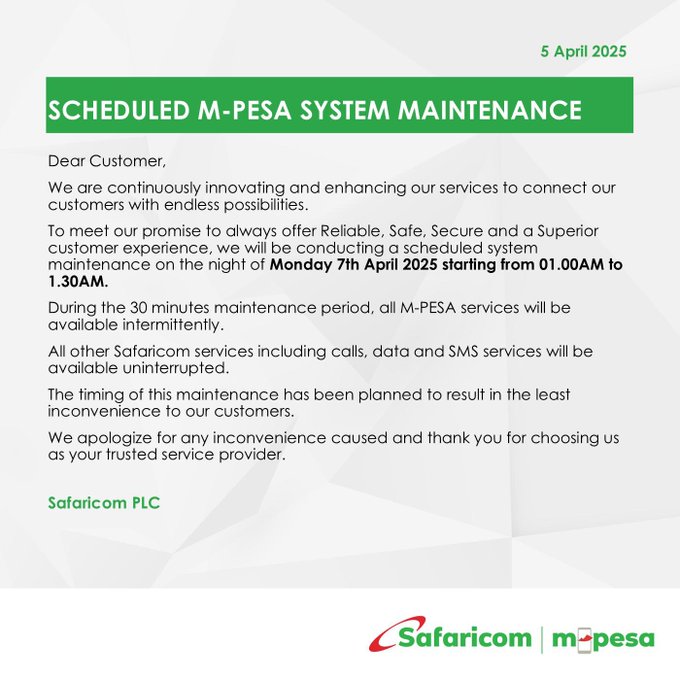

Safaricom PLC has announced that its popular mobile money platform, M-Pesa, will undergo scheduled system maintenance in the early hours of Monday, April 7, 2025, from 1:00 am to 1:30 am EAT.

The telco made the announcement via a public notice on Saturday, citing ongoing efforts to enhance service delivery and improve customer experience.

Customer Notice.

A Carefully Timed Tune-Up

According to Safaricom, the 30-minute maintenance window has been deliberately scheduled during off-peak hours to minimize any disruption.

Still, for that brief half-hour, M-Pesa services will be available intermittently. That means everything from P2P transfers and Pay Bill transactions to Buy Goods and international remittances could be spotty or temporarily unavailable.

Notably, Safaricom emphasized that other core services like voice calls, SMS, and mobile data will remain fully functional during the system upgrade.

For users accustomed to round-the-clock access to mobile money services, the company’s assurance might feel like a blip on the radar.

And to be fair, 30 minutes isn’t much—unless you’re in the middle of a late-night transaction, topping up for an Uber, or trying to beat a payment deadline.

Safaricom also took the opportunity to thank customers for their continued loyalty, adding, “We apologize for any inconvenience caused and thank you for choosing us as your trusted service provider.”

With millions relying on M-Pesa daily for everything from buying airtime to paying rent, these updates are part of what keeps the system running like clockwork—especially in a digital economy that increasingly depends on frictionless mobile transactions.

18 Years of M-Pesa: From Start-Up to Staple

This announcement comes just weeks after M-Pesa celebrated 18 years since its groundbreaking debut on March 6, 2007.

What started as a local peer-to-peer money transfer tool has since blossomed into a regional fintech juggernaut, now used across multiple countries and integrated with banks, utilities, and global platforms.

From offering access to financial services for the unbanked to evolving into a one-stop financial ecosystem, M-Pesa has come a long way.

It’s not just a Kenyan innovation anymore—it’s a global case study in mobile money success.

So if you’re planning to transact during that early morning window, either do it before the clock strikes 1:00—or grab some coffee and wait it out. After all, even fintech needs a power nap.