NAIROBI, Kenya — The Insurance Regulatory Authority (IRA) has revoked the operating licences of 20 insurance brokerage firms in a renewed effort to enforce regulatory compliance and strengthen oversight in the sector.

In a public notice issued on Thursday, the regulator said the firms were deregistered in line with Section 196(A) of the Insurance Act (Cap. 487), which allows the cancellation of licences for failure to meet set legal and operational requirements.

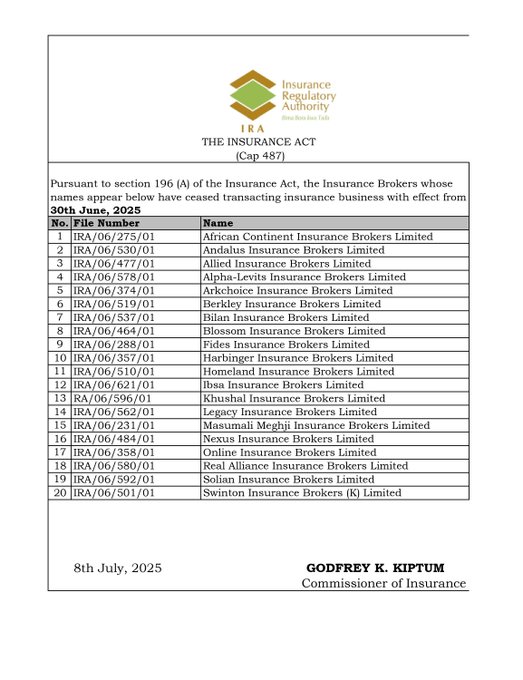

“The Insurance Regulatory Authority hereby notifies the public that licences of 20 insurance brokers have been cancelled,” the notice stated, adding that the firms are no longer authorised to transact insurance business effective June 30, 2025.

Gazette Notice on Cancellation of Operational Licences for 20 Brokers: The Insurance Regulatory Authority (IRA) hereby notifies the public that licences of the following twenty (20) Insurance Brokers have been cancelled pursuant to Section 196(A) of the Insurance Act (Cap. 487).

The IRA did not disclose the specific reasons behind the cancellations. However, sources familiar with regulatory trends say such actions are often linked to breaches such as non-compliance with premium handling rules, failure to submit mandatory filings, or financial irregularities.

The latest move comes amid the IRA’s continued efforts to clean up the insurance industry and protect consumers from unscrupulous or non-compliant intermediaries.

The Authority, a statutory body mandated to supervise and promote the development of the insurance market in Kenya, has previously flagged challenges around unpaid premiums and weak internal controls among brokers.

In recent years, the sector has faced rising concerns over delayed remittance of premiums by intermediaries, with estimates in 2018 putting outstanding premiums at over KSh 43 billion.

Industry insiders have warned that such lapses expose underwriters and policyholders to financial risk.

The IRA has on multiple occasions urged industry players to align with the provisions of the Insurance Act and maintain transparency in their operations.

The Authority also publishes periodic lists of licensed entities to help consumers verify the legitimacy of firms before engaging in insurance transactions.

The cancellation of licences is expected to send a strong message to the industry that regulatory compliance is non-negotiable.

Consumers are advised to confirm the licensing status of any broker through the official IRA website or contact the Authority directly before engaging in business with intermediaries.